LOAN MANAGEMENT

LOAN MANAGEMENT

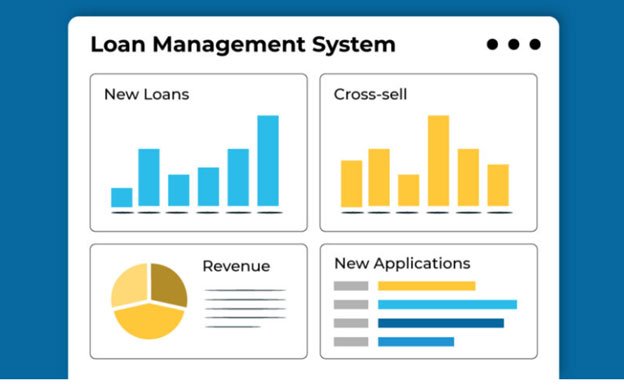

Raygain having software platform designed to manage the entire lifecycle of a loan, from origination to closure. It streamlines processes for lenders, borrowers, and other stakeholders, ensuring efficient and error-free management of loan-related activities.

Key Features of a Loan Management System:

- Loan Origination:

- Application processing (manual or online).

- Credit scoring and risk assessment.

- Document verification and KYC compliance.

- Automated loan approval workflows.

- Loan Servicing:

- Disbursement tracking.

- EMI (Equated Monthly Installments) calculation.

- Interest rate management (fixed or floating).

- Payment collection and reminders.

- Loan Monitoring:

- Borrower activity tracking.

- Real-time account status updates.

- Delinquency management and follow-ups.

- Reporting & Analytics:

- Customizable dashboards.

- Financial performance reports.

- Risk and compliance tracking.

- Portfolio management insights.

- Customer Relationship Management (CRM):

- Borrower communication tools.

- Notifications and alerts (via SMS, email, or app).

- Self-service portals for borrowers to check status and make payments.

- Compliance and Security:

- Regulatory compliance (country-specific, such as RBI in India).

- Data encryption and secure storage.

- Fraud detection and mitigation tools.

- Integration Capabilities:

- Integration with accounting systems (e.g., QuickBooks, Tally).

- API connectivity with third-party tools (credit bureaus, payment gateways).

- Cloud or on-premise deployment options.

Key Features of a Loan Management System:

- Efficiency: Automates manual processes, saving time and reducing errors.

- Scalability: Easily manages growing loan portfolios.

- Customer Satisfaction: Faster approvals and better communication.

- Cost-Effective: Reduces operational expenses by optimizing workflows.

- Regulatory Compliance: Helps ensure adherence to local and global lending regulations.